FINANCES AT YOUR FINGERTIPS!

With RVCU’s online and mobile banking platforms, your money moves with you! Whether you’re lounging in your pajamas or sunning on the beach, you can securely access your account anywhere, anytime, 24/7/365 online or through our mobile app.

Bank Anytime, Anywhere

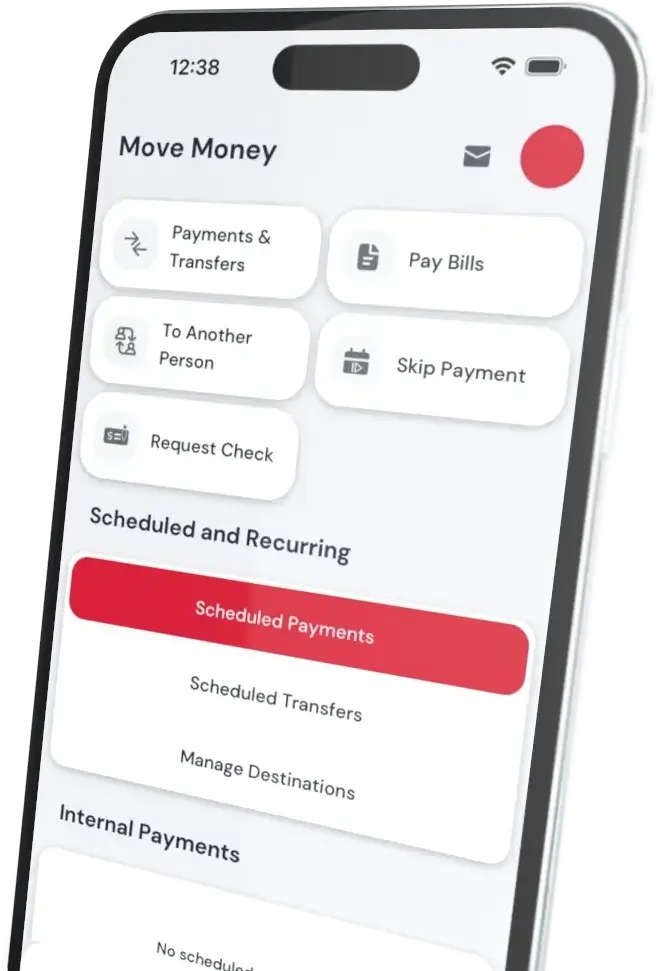

With RVCU online and mobile banking, you can do just about anything. View balances, transfer money, pay bills, find ATMs, and so much more:

- Check account balances

- Transfer money

- Open additional accounts

- Securely control credit and debit cards

- Review statements

- Pay bills

- Set alerts and notifications

- Manage debit and credit card rewards

- Make person-to-person (P2P) payments

- Check your credit score

- Apply for a loan and make payments

- Locate surcharge free ATMs

- Deposit checks (mobile only)

READY TO MANAGE YOUR MONEY FROM WHEREVER LIFE TAKES YOU?

Enroll In Online Banking and Download Our Mobile App Today!

Personalized Service + Digital Convenience. It’s A Win-Win!

You’ve probably heard of an ATM, but what about a PTM? RVCU’s Personal Teller Machines (PTMs) are a hybrid between automated and personalized banking services. You get all the conveniences of ATMs while talking to a real person. Pretty great, right?

At PTMs you can deposit cash and checks, transfer funds, make a loan payment, withdraw cash, check your balance, and more — all while video chatting with an RVCU teller. Our video tellers will guide you through every step of your transaction and can answer any questions about your accounts.

PTMs are located at all RVCU branches and with drive thru options — you don’t even have to leave your car. Video tellers are available during normal business hours. After that, you can still access all the basic ATM features you’re used to — deposit checks, withdraw cash, and check your balances 24/7/365.

We’d say that’s banking for wherever life takes you!

Resources & Promotions

Interested in learning more? Check out these great articles and resources, tailored just for you.

Your financial world at your fingertips! With RVCU’s online and mobile banking platforms, your money moves with you! Whether you’re in your pajamas or on the beach, your finances are only a click or a touch away. Ready to securely access your accounts from wherever life takes you? Enroll in Digital Banking and download our […]